They still aren’t there, but cryptocurrencies are shaping up to be the way payments will be done in the future. They started as a novelty back in 2009 and soon were seen as a way to disrupt traditional banking. The specialized public has recently started to recognize cryptocurrencies as a disrupting financial technology. What are the advantages of cryptocurrencies?

What really matters is that the marketplace accepts them. There are approximately 15,174 businesses worldwide that take Bitcoin as a form of payment. 2,300 of those are found in the United States, along with 36,659 Bitcoin ATMs. Bitcoin is one of the top three cryptocurrencies available (as measured by their market cap). Ethereum and Tether are the other two (US$318 billion, US$146 billion, and US$66 billion, respectively). However, this is the surface level.

There are more than 12,000 choices of cryptocurrencies available today. This is evidence of how easy it is to kick-start a new cryptocurrency. It also shows that there is a growing interest in the technology. Why should you incorporate cryptocurrencies in your business?

Advantages of Cryptocurrencies. A growing relevancy in tomorrow’s marketplace

You can boost your business and brand recognition by receiving a new technology with open arms. Cryptocurrencies are no exception. By accepting them as forms of payment, a business spreads awareness about them, both to the employees as well as to the clients. Why is it important to spread the word about this? Because There are already talks about centralized bank digital currencies.

This is a development that will take many people by surprise, so it is important to get used to it. Businesses can accept cryptocurrencies for their current line of products, or for new revenue streams. For example, a business can sell to its customers airtime top ups and data bundles in exchange of cryptocurrencies. Digital gift cards too. To do so, a business will require a flexible API (Application Programming Interface) to facilitate the deal. Company’s like Reloadly can be of help in cases like these.

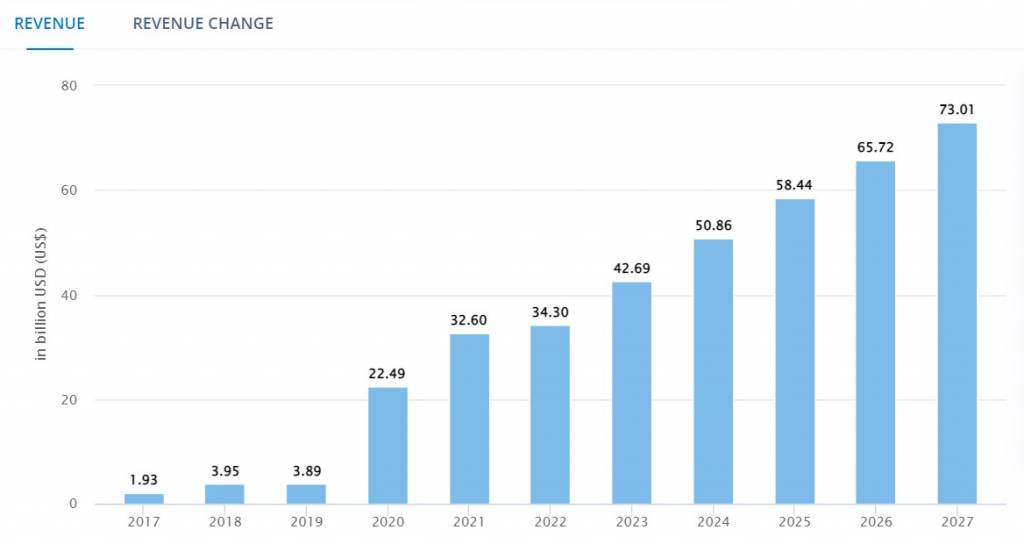

Cryptocurrencies follow the footsteps growing digital trends, as well as the gradual vanishing of physical money. Digital wallets and currencies are no longer a curiosity, and they have seen a rapid growth in popularity since 2016. 347 million users of digital currencies will be around by 2027. Worldwide revenues will reach up to US$ 73 billion in the same year.

Customers can buy digital gift cards, as well as data bundles and airtime

Traditional businesses may find it overwhelming to accept this new technology. But not doing so only delays the inevitable. Traditional payment methods are on their way out, even if this is still a few years ahead.

Businesses can be part of the cryptocurrency revolution by gradually selling digital goods. Airtime and data bundles are attractive products that can easily be sold for cryptocurrencies because they give real world value to crypto coins. Why so? The technology is still very volatile. Few people want to run risks with it, as they assume its value will plummet any minute.

But digital goods like airtime and data bundles are a different story.

Better chances at the playing field and more customers.

A business that receives cryptocurrencies will place itself in a top-tier position. This is an emerging digital economy, so it is convenient to be an early adopter. It will take time, but cryptocurrencies will replace fiat paper money, eventually. As these digital currencies grow in popularity, more clients will want to engage with businesses that accept this payment method. One of the advantages of cryptocurrencies is that a business will secure its place once it knows how to handle these payments.

This is a strategic approach for business relevance in the mid to long term. A study by Forrester Consulting has found that businesses that accept cryptocurrencies attract new customers. Roughly 40% of those who make payments with cryptocurrencies are new clients to a business. Their purchases tend to be twice that of those done with credit cards or other means.

One of the advantages of cryptocurrencies is the availability of funds. Businesses that accept cryptocurrencies don’t need to wait for them to be available in their bank accounts, unlike other payments. Transactions occur in real time, or a few minutes. Payments are not slowed down by bank politics. More importantly, cryptocurrencies work all around the world.

A wall against fraud

Payments done with cryptocurrencies, unlike credit cards, see no fraudulent chargebacks. This is a problem that businesses must deal with constantly, one that is starting to reach dangerous proportions due to the ease at which identity and credit card theft is done these days.

One of the advantages of cryptocurrencies is its digital encryption. It acts as a stone wall that prevents this kind of crime. In this regard, paying with them is like paying with cash at a physical store. Either the client has the funds, or he doesn’t. It is impossible for a client that pays with digital currencies to spend more than what’s under his name. Also, both the business and the client need to concur on each transaction. This means that there are no disagreements about what’s been done, keeping everything professional and free of chargeback.

The money stays put

Last year, Visa and Mastercard raised their credit and debit card fees for businesses. This move that has been heavily criticized because it will worsen inflation. Merchants have paid over US$ 78 billion in such fees in the USA alone. All of it during the last few years. Cryptocurrencies, on the other hand, are not centralized. This means that there is no bank or entity needed to verify each transaction made. This is one of the biggest advantages of cryptocurrencies.

Businesses that accept digital currencies for payments will cut down these fees. They usually cost roughly between 2 to 5% for each transaction made. All revenue made from purchases paid for with cryptocurrencies will remain within the business. Not a cent of it will end in the coffers of banking institutions.

Easy to receive and process

We have stablished that it is a good idea for business to accept digital currencies as valid payment methods. We have also stablished that businesses can start accepting cryptocurrencies by selling airtime, data bundles, and digital gift cards. Now we need to stablish how to do so.

Another one of the advantages of cryptocurrencies is how easy it is to accept them. There are a few basic steps that need to be considered, but the process is simple enough. It shouldn’t take more than a few days.

Find and setup a merchant wallet account that best fits the business

It is important to first know what digital currency a business wants to accept. Some merchant wallets only accept Bitcoin. There are others that accept alternative cryptocurrencies.

What kind of digital currency to accept depends on various criteria. A business needs to take its time and consider the value of one over the other.It all comes down to how each currency is produced and spend. Some cryptocurrencies, like Bitcoin and Monero, are produced through “mining”, which involves using powerful computers to solve complex cryptographic problems. Others, like NEM, are produced through a different kind of algorithm that does not require sophisticated hardware.

Incorporate cryptocurrency into points of purchase

Businesses should next integrate their wallet’s public address into their physical points of purchase. Physical points of purchase should have an app that works for both smartphones and tablets. It generates a QR code specific for customers to pay with their cryptocurrencies.

Next, integrate a cryptocurrency option into the business’ website.

Integrate with a powerful API for top ups

Reloadly offers powerful APIs for top ups. Both for airtime and data bundles, as well as for digital gift cards. There APIs are easy to integrate into a business’ web, and even easier to operate. They come with no contracts, and once they are in place, businesses can start selling digital goods that accept cryptocurrencies.

Start selling digital goods like airtime, data bundles and digital gift cards

A business can start selling these goods as a first line of products that accept cryptocurrencies. What is airtime? That’s the time a user has to talk on a mobile phone operated by a network. What are data bundles? These are packs of gigabytes to access the internet through a mobile phone. Both products are very popular among migrant workers, expats, and digital nomads who want to stay in touch with their families back home. Airtime is popular in countries where prepaid mobile plans are big. Like Cuba, India, Nigeria, and many other countries in Latin América, Asia and Africa.

Digital money for digital goods

Even though cryptocurrencies are growing and growing, there is still some resistance along the way. Many businesses still do not want to accept them due perceived volatility or lack of reliance. However, these digital currencies can easily be exchanged for other digital goods. Goods like airtime top ups, data bundles and digital gift cards. This transfers value to tangible goods and services.

Reloadly’s API for top ups can help with this. By incorporating it into their websites, businesses can offer their customers the choice of using Bitcoin or other cyptocurrencies. The obstacles encountered by cryptocurrencies will vanish when the wider public accepts the technology.

The world is quickly becoming a digital world. It is a matter of time before this new form of payment becomes second nature to us. Get in touch with Reloadly’s team . Today you can be part of this amazing way in which businesses will be conducted tomorrow.